Reports

Sale

Global Ultralight and Light Aircraft Market Size, Forecast: By Aircraft Type: Light Aircraft, Ultralight Aircraft; By End Use: Civil and Commercial, Military; By Flight Operation: Vertical Take-Off and Landing (VTOL), Conventional Take-Off and Landing (CTOL); By Propulsion; Regional Analysis; Market Dynamics; Competitive Landscape; 2024-2032

Global Ultralight and Light Aircraft Market Outlook

The global ultralight and light aircraft market size reached USD 8.33 billion in 2023. The market is expected to grow at a CAGR of 4.5% between 2024 and 2032, reaching almost USD 12.37 billion by 2032.

Key Takeaways:

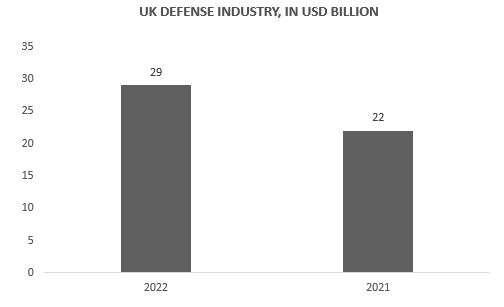

- In 2022, the UK civil aerospace sector's revenue reached approximately $34.5 billion, thus significantly boosting the global ultralight and light aircraft market.

- According to the International Trade Administration, India has the potential to emerge as the world's premier aviation market by 2047.

- The International Air Transport Association aims for net-zero aviation emissions, focusing on sustainable fuels, innovative propulsion, and improved air traffic.

The Experimental Aircraft Association defines an ultralight as an aircraft meeting the following specifications: it accommodates one person, with a maximum empty weight of 254 lbs for powered aircraft and 155 lbs for unpowered ones. It can carry up to 5 gallons of fuel, attains a maximum speed of 55 knots at full power, and has a maximum stall speed of 24 knots when power is off.

A light aircraft, defined as a fixed-wing plane with a maximum take-off weight of 5,670 kg, is notably smaller than most multi-engine planes. Usually single engine, they typically seat up to four people. These planes are favoured by novice pilots for their simple controls and standard design. They're commonly used for training, sightseeing, and experience flights.

As per the International Trade Administration, the UK aerospace sector ranks second globally and operates as an export-oriented industry. In 2022, the UK civil aerospace sector generated around $34.5 billion in revenue, contributing significantly to the global demand for ultralight and light aircraft.

Key Trends and Developments

The global ultralight and light aircraft market growth is driven by the introduction of new-generation planes, increased commercial applications, expanding use in agriculture, and growing interest as a leisure pursuit.

November 2023

SaxonAir launched the world's inaugural certified electric aircraft, the Pipistrel Velis Electro, which represented a significant leap in aviation technology. This small two-seat electric plane offered a sustainable alternative for pilots, potentially opening doors for wider adoption.

July 2023

Emirates launched a regional private jet service utilizing a fleet of Embraer Phenom 100 twin-engine planes, typically employed by the Dubai-based airline for its internal pilot training academy.

June 2023

Honda Aircraft progressed with the development of the HondaJet 2600 concept light jet, revealed at NBAA-BACE 2021. Certification is targeted for 2028.

March 2023

India's plans for small aircraft manufacturing began to materialize in 2024 with the development of SARAS MK II prototypes.

New generation aircraft

The global ultralight and light aircraft market developments are attributed to the growing focus on reducing emissions. The International Air Transport Association aims for the aviation industry to achieve net-zero carbon emissions by prioritizing significant emission reductions at the source.

Commercial application

As per the global ultralight and light aircraft market analysis, the industry is propelled by various applications like aerial surveying for pipeline monitoring, light cargo transport to supply cargo hubs, and passenger services. Light and ultralight aircraft serve roles in marketing, such as banner towing and skywriting, along with flight training, recreational pursuits, charter flights, tourism, and medical missions.

Growing utilisation in agriculture

In agriculture, light and ultralight aircraft are commonly utilised for tasks such as aerial application of pesticides (crop dusting) or fertilizers (aerial topdressing) and hydroseeding, contributing to the growing demand.

Leisure pursuit

Ultralight and light aircraft present an exhilarating hobby for aviation enthusiasts, offering the freedom of open-air flight and unique landscape views. Crafting and customizing these planes combine creativity and technicality, uniting a passionate community of flying enthusiasts.

Global Ultralight and Light Aircraft Market Trends

As per the global ultralight and light aircraft market report, ultralight and light aircraft also find applications in sports and recreational activities, including five main categories: racing, aerobatics, homebuilt aircraft, antique planes, and rotorcraft. Due to fewer regulations and operational complexities, those flying for leisure will discover ultralight operations less constraining.

Moreover, their cost-effectiveness is evident, as light jets consume less fuel compared to larger aircraft, resulting in more economical operation.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Segmentation

Global Ultralight and Light Aircraft Market Report and Forecast 2024-2032 offers a detailed analysis of the market based on the following segments:

Market Breakup by Aircraft Type

- Light Aircraft

- Ultralight Aircraft

Market Breakup by End Use

- Civil and Commercial

- Military

Market Breakup by Flight Operation

- Vertical Take-Off and Landing (VTOL)

- Conventional Take-Off and Landing (CTOL)

Market Breakup by Propulsion

- Electric/Hybrid

- Conventional Fuel

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

The global ultralight and light aircraft market is seeing a boost from the use of light aircraft, which play essential roles in sports, commercial ventures, medical missions, and agricultural activities, depending on the specific type of aircraft

A light aircraft is utilised commercially for passenger and cargo transportation, sightseeing, photography, and various other tasks, along with personal use.

An ultralight aircraft, on the other hand, is a lightweight plane designated for sport and recreational flying only. An ultralight does not necessitate FAA registration or a pilot's license.

Based on end use, global ultralight and light aircraft market share is driven by diverse applications in civil and commercial sectors, serving purposes such as passenger and cargo transportation, sightseeing, photography, and various other roles, as well as personal recreational use

A light combat aircraft (LCA) is a military aircraft that is lightweight and versatile, often developed from advanced trainer aircraft designs. It is specifically designed for light combat engagements, with missions ranging from light strike or attack operations to reconnaissance, interdiction, or training roles.

The global ultralight and light aircraft market is witnessing a rise in electric/hybrid propulsion systems due to the growing demand for sustainable options

Hybridization improves energy management, resulting in up to a 5% reduction in fuel consumption compared to conventional flights. Electric propulsion systems offer benefits such as energy savings and improved cost-effectiveness.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Competitive Landscape

Key players are propelling the global ultralight and light aircraft market by specializing in aircraft tailored for specific markets.

American Legend Aircraft Company, situated in the United States, produces domestically manufactured sport aircraft. It has earned a reputation as a contemporary icon, with pilots often regarding the Legend Cub as the most enjoyable recreational aircraft currently available. The present-day Legend Cub is a newly designed, factory-built plane, created in homage to the iconic Piper J-3, PA-11, and PA-18 Super Cubs.

Pilatus Aircraft Ltd., established in 1939, and headquartered in Switzerland, specializes in crafting aircraft primarily tailored for specific markets, notably focusing on short take-off and landing (STOL) planes along with military training aircraft.

AutoGyro GmbH founded in 1999 and headquartered in Germany, is a company specializing in the creation and production of autogyros, offering fully assembled aircraft ready for flight. The company has achieved commercial success with its designs, incorporating features such as a mast-mounted vibration-dampening system.

Textron Inc. was established in 2014 and is situated in the United States, it is renowned for its design, construction, and support of versatile military aircraft, widely favoured for both training purposes and attack missions.

Other key players in the global ultralight and light aircraft market are Aeropro SK s.r.o., ATEC v.r.o, Evektor, spol. s r. o., and Air Tractor, Inc. among others.

Global Ultralight and Light Aircraft Market by Region

The aviation and aerospace sector in North America is experiencing steady growth, leading to a heightened need for ultralight and light aircraft. This demand surge is propelled by factors such as the rapid expansion of aircraft manufacturing, technological advancements, and the flourishing travel and tourism industry.

Based on geography. global ultralight and light aircraft market share is estimated to be led by the Asia-Pacific region. India, with its rapidly expanding civil aviation sector, is forecasted to surpass 500 million domestic and international air travellers by 2030. According to the International Trade Administration, India has the potential to emerge as the world's premier aviation market by 2047.

U.S.-INDIA CIVIL AVIATION TRADE DATA

| 2021 | 2022 | |

| U.S. exports to India ($ million) | 1,378 | 2,446 |

| India’s total imports ($ million) | 4,654 | 9,343 |

| Number of domestic passengers (millions) | 84 | 136 |

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Aircraft Type |

|

| Breakup by End Use |

|

| Breakup by Flight Operation |

|

| Breakup by Propulsion |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Market Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Ultralight and Light Aircraft Market Analysis

8.1 Key Industry Highlights

8.2 Global Ultralight and Light Aircraft Historical Market (2018-2023)

8.3 Global Ultralight and Light Aircraft Market Forecast (2024-2032)

8.4 Global Ultralight and Light Aircraft Market by Aircraft Type

8.4.1 Light Aircraft

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Ultralight Aircraft

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.5 Global Ultralight and Light Aircraft Market by End Use

8.5.1 Civil and Commercial

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Military

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.6 Global Ultralight and Light Aircraft Market by Flight Operation

8.6.1 Vertical Take-Off and Landing (VTOL)

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Conventional Take-Off and Landing (CTOL)

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.7 Global Ultralight and Light Aircraft Market by Propulsion

8.7.1 Electric/Hybrid

8.7.1.1 Historical Trend (2018-2023)

8.7.1.2 Forecast Trend (2024-2032)

8.7.2 Conventional Fuel

8.7.2.1 Historical Trend (2018-2023)

8.7.2.2 Forecast Trend (2024-2032)

8.8 Global Ultralight and Light Aircraft Market by Region

8.8.1 North America

8.8.1.1 Historical Trend (2018-2023)

8.8.1.2 Forecast Trend (2024-2032)

8.8.2 Europe

8.8.2.1 Historical Trend (2018-2023)

8.8.2.2 Forecast Trend (2024-2032)

8.8.3 Asia Pacific

8.8.3.1 Historical Trend (2018-2023)

8.8.3.2 Forecast Trend (2024-2032)

8.8.4 Latin America

8.8.4.1 Historical Trend (2018-2023)

8.8.4.2 Forecast Trend (2024-2032)

8.8.5 Middle East and Africa

8.8.5.1 Historical Trend (2018-2023)

8.8.5.2 Forecast Trend (2024-2032)

9 North America Ultralight and Light Aircraft Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Ultralight and Light Aircraft Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Ultralight and Light Aircraft Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Ultralight and Light Aircraft Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Ultralight and Light Aircraft Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Value Chain Analysis

16 Competitive Landscape

16.1 Market Structure

16.2 Company Profiles

16.2.1 American Legend Aircraft Company

16.2.1.1 Company Overview

16.2.1.2 Product Portfolio

16.2.1.3 Demographic Reach and Achievements

16.2.1.4 Certifications

16.2.2 Aeropro SK s.r.o.

16.2.2.1 Company Overview

16.2.2.2 Product Portfolio

16.2.2.3 Demographic Reach and Achievements

16.2.2.4 Certifications

16.2.3 AutoGyro GmbH

16.2.3.1 Company Overview

16.2.3.2 Product Portfolio

16.2.3.3 Demographic Reach and Achievements

16.2.3.4 Certifications

16.2.4 Textron Inc.

16.2.4.1 Company Overview

16.2.4.2 Product Portfolio

16.2.4.3 Demographic Reach and Achievements

16.2.4.4 Certifications

16.2.5 ATEC v.o.s

16.2.5.1 Company Overview

16.2.5.2 Product Portfolio

16.2.5.3 Demographic Reach and Achievements

16.2.5.4 Certifications

16.2.6 Evektor, spol. s r. o.

16.2.6.1 Company Overview

16.2.6.2 Product Portfolio

16.2.6.3 Demographic Reach and Achievements

16.2.6.4 Certifications

16.2.7 Pilatus Aircraft Ltd.

16.2.7.1 Company Overview

16.2.7.2 Product Portfolio

16.2.7.3 Demographic Reach and Achievements

16.2.7.4 Certifications

16.2.8 Air Tractor, Inc.

16.2.8.1 Company Overview

16.2.8.2 Product Portfolio

16.2.8.3 Demographic Reach and Achievements

16.2.8.4 Certifications

16.2.9 Others

17 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Ultralight and Light Aircraft Market: Key Industry Highlights, 2018 and 2032

2. Global Ultralight and Light Aircraft Historical Market: Breakup by Aircraft Type (USD Million), 2018-2023

3. Global Ultralight and Light Aircraft Market Forecast: Breakup by Aircraft Type (USD Million), 2024-2032

4. Global Ultralight and Light Aircraft Historical Market: Breakup by End Use (USD Million), 2018-2023

5. Global Ultralight and Light Aircraft Market Forecast: Breakup by End Use (USD Million), 2024-2032

6. Global Ultralight and Light Aircraft Historical Market: Breakup by Flight Operation (USD Million), 2018-2023

7. Global Ultralight and Light Aircraft Market Forecast: Breakup by Flight Operation (USD Million), 2024-2032

8. Global Ultralight and Light Aircraft Historical Market: Breakup by Propulsion (USD Million), 2018-2023

9. Global Ultralight and Light Aircraft Market Forecast: Breakup by Propulsion (USD Million), 2024-2032

10. Global Ultralight and Light Aircraft Historical Market: Breakup by Region (USD Million), 2018-2023

11. Global Ultralight and Light Aircraft Market Forecast: Breakup by Region (USD Million), 2024-2032

12. North America Ultralight and Light Aircraft Historical Market: Breakup by Country (USD Million), 2018-2023

13. North America Ultralight and Light Aircraft Market Forecast: Breakup by Country (USD Million), 2024-2032

14. Europe Ultralight and Light Aircraft Historical Market: Breakup by Country (USD Million), 2018-2023

15. Europe Ultralight and Light Aircraft Market Forecast: Breakup by Country (USD Million), 2024-2032

16. Asia Pacific Ultralight and Light Aircraft Historical Market: Breakup by Country (USD Million), 2018-2023

17. Asia Pacific Ultralight and Light Aircraft Market Forecast: Breakup by Country (USD Million), 2024-2032

18. Latin America Ultralight and Light Aircraft Historical Market: Breakup by Country (USD Million), 2018-2023

19. Latin America Ultralight and Light Aircraft Market Forecast: Breakup by Country (USD Million), 2024-2032

20. Middle East and Africa Ultralight and Light Aircraft Historical Market: Breakup by Country (USD Million), 2018-2023

21. Middle East and Africa Ultralight and Light Aircraft Market Forecast: Breakup by Country (USD Million), 2024-2032

22. Global Ultralight and Light Aircraft Market Structure

The market was estimated to be valued at USD 8.33 billion in 2023.

The market is projected to grow at a CAGR of 4.6% between 2024 and 2032.

The market is expected to reach USD 12.37 billion in 2032.

Factors driving the ultralight and light aircraft demand include the introduction of new-generation planes, increased commercial applications, expanding use in agriculture, and growing interest as a leisure pursuit.

The market is categorised according to its aircraft type, which includes light aircraft and ultralight aircraft.

The market key players are American Legend Aircraft Company., Aeropro SK s.r.o., AutoGyro GmbH, Textron Inc., ATEC v.o.s, Evektor, spol. s r. o., Pilatus Aircraft Ltd., and Air Tractor, Inc. among others.

Based on the flight operations it is divided into vertical take-off and landing (VTOL) and conventional take-off and landing (CTOL).

The major market areas include North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Based on the end use, the market is divided into civil commercial and military.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.