Larry Fink Bets Tokenization will be 100x Bigger than Bitcoin

In the fevered pitch of the latest Bitcoin bull run, it's easy to miss the bigger story.

As we zoom out from the immediate highs and lows of the crypto markets, a much more significant revolution is quietly gaining momentum: the tokenization of financial assets, a movement that could redefine investing as we know it.

Let's be blunt: the financial world as we know it is archaic. It's a maze of middlemen, from brokers to banks to clearinghouses, each taking a slice of the pie and slowing down transactions to a crawl.

In a world where technology has given us the means to communicate instantaneously across the globe, why does transferring ownership of assets feel like sending a letter by snail mail?

Enter blockchain technology. Beyond the buzz and the speculation lies a truly transformative idea: what if every financial asset could be represented digitally and securely on a blockchain?

This isn't just about cryptocurrencies; we're talking about everything from stocks and bonds to real estate.

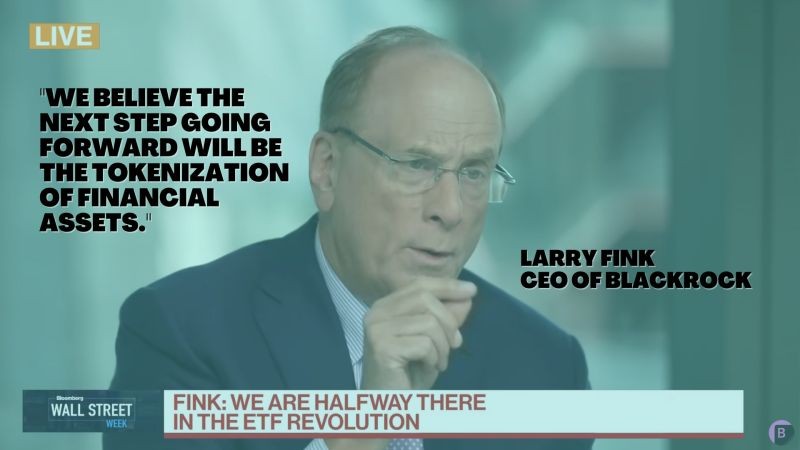

And Larry Fink, the CEO of BlackRock, isn't just watching from the sidelines. He's thrown down the gauntlet with his vision of "the tokenization of every financial asset." And he's not alone.

Estimates suggest that tokenized "real-world assets" could be worth a staggering $10 trillion by 2030.

In real estate tokenization, Imagine a world where buying a house no longer requires the costly and time-consuming process of title searches and title insurance, thanks to blockchain technology.

In this scenario, every property transaction is recorded securely and immutably on a blockchain, creating a clear, accessible history of ownership and liens. Think CarFax for real estate.

This transparency drastically reduces the need for title insurance and the associated due diligence, slashing costs for buyers and sellers.

Moreover, with smart contracts automating and verifying each step of the transaction, the process that once took weeks can now be completed in days or even hours, streamlining the entire real estate purchasing journey while ensuring accuracy and security.

This is the power of blockchain in transforming real estate transactions—making them faster, cheaper, and more reliable for everyone involved.

But here's the rub: this isn't a smooth road. The challenges are substantial, from technological hurdles to regulatory mazes. Our own SEC is not willing to provide a clearer path, so half of tokenization has to be done here and the other half in a foreign country like Dubai or El Salvador (for secondary market trading).

However, the tide is turning. Projects like UBS's digital bond and Blackrock’s tokenized money market fund on the blockchain are proving that traditional financial giants can innovate. HSBC's use of blockchain for settlement in repurchase agreements shows the old guard is learning new tricks.

The real kicker, though? Regulators are starting to come around. The UK, EU, and even the US are experimenting with "sandboxes" to allow financial institutions to test the waters of tokenization within a controlled regulatory environment.

This is more than just bureaucratic wheel-spinning; it's a sign that the powers that be recognize the potential of blockchain to revolutionize finance—and they're willing to adapt to accommodate it.

So here's my take: While Bitcoin and Ethereum are getting all of the buzz, these are merely precursors to a 100X bigger opportunity.

The tokenization of assets is not just an interesting sidebar in the story of blockchain technology. It's the main event. It's a seismic shift that promises to make investing more efficient, transparent, and accessible.

The journey won't be without its bumps, but the destination? It's a future where the real estate on your screen can be as liquid as the cash in your wallet, where investing in a startup on the other side of the world is as simple as buying a book online.

Yes, there are mountains to climb just like there were for Ethereum and Bitcoin, but the potential for tokenization to reshape the landscape of investing is too great to ignore.

To those entrenched in the old ways, consider this a wake-up call. The future is tokenized!

Chief Executive Officer at dEquity. Bringing Real Estate On-Chain. RWA Tokenization. ABC - Asset-Backed Crypto. Digital Assets. #Web3 / DeFi / Co-Founder at XchangePlus and My Broker Tools.

1moThanks for the article, Mark! Tokenization is the future of the real estate market, and it looks like the future is already here.

Chief Executive Officer at dEquity. Bringing Real Estate On-Chain. RWA Tokenization. ABC - Asset-Backed Crypto. Digital Assets. #Web3 / DeFi / Co-Founder at XchangePlus and My Broker Tools.

1moWelcome to dEquity, where real estate meets Web3. https://dequity.io/

Co-Founder Smartblocks, tokenization, real world assets, Forbes top 25 CMO

1moBill Shopoff

💎LinkedIn Top Voice | Leadership & Career Coach | Keynote Speaker | Workshop Facilitator | Professional Branding | Outplacement Services | Career Transition & Promotion | Job Search | Interview Prep | Salary Negotiation

1moInteresting. I am still on the fence with this tokenization/crypto/bitcoin stuff. Too complicated for me right now and as Buffett says, I only buy what I understand Mark Fidelman I used to like the little cute NFTs like Lil Hippo. Man, they were cute. I almost bought one. LOL. I went into Discord one night and it was like going into hell, people talking about bots and people stealing other people's information. I stay away.

🌸LinkedIn Top Voice 2024 | Entrepreneurial Helpmeet | Professional Mom | Student of Thought Leaders | Virtual Educator | Bank Software Evangelist | Active Philanthropist | Linkie Cheerleader 🌸

1moAll asset holders could leverage tokenization to not only lower costs associated with security management, but it can simplify the infrastructure and reduce the need for multiple asset and payment gateways. Seeking to help banks ditch the legacy systems first treasury services, with iCG Pay, our software tokenizes both the CC and ACH transactions for them, too. It wasn’t and is not still necessary to do so for ACH, but this process enhances the security of the transaction. Enhance security-> enhance efficiency and reduce costs. In securities and asset management, while tokenization has a slightly different procedure and association, it still reigns true that a higher of level of security rests in leveraging a token based procedure. Financial institutions benefit in numerous facets with this technology that goes beyond fraud type security though, including increased liquidity because the division of ownership of securities as in assets because theyre broken into smaller units for fractional ownership and the market to buy and sell remains open 24/7, unlike traditional financial institutions. I see this next step Larry Fink discusses beneficial to our future with financial institutions and secured stability. Mark Fidelman