Rare-Earth Metals Market by (Lanthanum, Cerium, Neodymium, Praseodymium, Samarium, Europium, & Others), and Application (Permanent Magnets, Metals Alloys, Polishing, Additives, Catalysts, Phosphors), Region – Global Forecast to 2026

Updated on : April 03, 2024

Rare Earth Metals Market

The rare earth metals market was valued at USD 5.3 billion in 2021 and is projected to reach USD 9.6 billion by 2026, growing at 12.3% cagr from 2021 to 2026. The increasing use of rare-earth elements that are used in the permanent magnet application are likely to drive the rare-earth metals market. APAC is the fastest-growing market for rare-earth metals due to increase in production and consumption in China. Significant usage of permanent magnets offer a huge impetus to these advanced materials, are expected to drive the rare-earth metals market in the region.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 impact on Global Rare-Earth Metals Market

The rare-earth metals industry was majorly impacted by COVID-19. In the initial stages of the pandemic, factories in several countries were forced to shut down as the governments implemented strict lockdowns to stop the spread of the virus. After the lockdown was lifted and restrictions were eased, rare-earth metals manufacturers were allowed to resume factory operations but at a limited capacity and under several rules and regulations.

The COVID-19 pandemic has already by now caused profound effects at the global macroeconomic scale. In the automotive industry, for example, car manufacturers had announced a halt in production , which is now gradually resuming again. Tier 1 and Tier 2 suppliers and other market actors further upstream are similarly affected by this demand-side shock and have consequently ramped down their production as well. In addition to such demand-side shocks, supply chain steps located in countries strongly affected by the virus are hampered, too, leading to the breaking of entire international supply chains. This makes it clearer than ever before that the security of the supply of strategic raw materials needed for the long-term competitiveness and job security in key industries is of prime importance for the European Union. The European Green Deal targets 2050 climate neutrality and recognizes access to resources as a strategic security question to fulfil its ambition. The new Industrial Strategy for Europe sees raw materials as key enablers for a globally competitive, green and digital Europe. It envisions European competitiveness based on a new Alliance on Raw Materials and highlights the importance of industrial ecosystems for accelerating innovation and growth in Europe. A more resilient, more protective, more sovereign and more inclusive economic model that aligns with the Green Deal has also been prioritized by the recently launched Green Recovery Alliance. EIT RawMaterials, funded by the European Institute of Innovation and Technology (EIT), has the vision to develop raw materials into a major strength for Europe. It is the world’s largest network in the raw materials sector connecting industry, research, and education. This makes EIT RawMaterials a key contributor to secure sustainable access and supply of raw materials – for a green, digital, and competitive Europe.

The coronavirus outbreak in China has had a foreseeable but unintended consequence. Truck drivers have refused to make deliveries into areas either identified as or suspected of harboring the disease. This has interrupted not only the flow of minerals out of the affected areas but also the refining and manufacturing of metals, food, and fuel. Among the under-reported deficiencies, thereby caused the most important ones for the global rare-earth metals production and utilization industries is the interruption in the flow of chemical reagents necessary for refining rare-earth metals and for producing metals, alloys, and magnets.

Rare-earth-enabled components for moving machinery, such as automobiles, trucks, trains, aircraft, industrial motors and generators, home appliances, and consumer goods, almost all of these are procured from China or Japan (which of course gets its rare-earth magnets, alloys, phosphors, and catalysts from China). That flow is now slowing. This will have a domino effect on American and European industries. These items cannot be re-sourced due to China’s monopoly of rare-earth metals production and its monopsony of rare-earth-enabled component manufacturing.

Rare-Earth Metals Market Dynamics

Driver: Increasing demand from end-use industries

Rare-earth metals, owing to their various properties, find applications in a wide range of industries. These applications include permanent magnets, metal alloys, phosphors, catalysts, polishing, and glass additives.

Rare-earth permanent magnets are expected to be the prime growth market over the next five to ten years. The major rare-earth elements that are used in the permanent magnet application are neodymium, praseodymium, dysprosium, terbium, and yttrium. These metals possess special properties, such as remanence, high coercivity, which keeps the permanent magnets from losing their magnetivity even after long periods. These magnets find major applications in the automotive market, and their demand is dependent on this market. The rare-earth permanent magnets find use in both conventional automotive as well as hybrid vehicles. In fact, the hybrid electric vehicle (HEV) market is expected to drive a stronger growth for rare-earth magnets in the near future as they use more rare-earth magnets per vehicle when compared to conventional automotive. Generally, a hybrid car contains 650 grams or 1,000 grams of neodymium.

The application of rare-earth magnets in wind turbines is expected to be another major growth market over the long term. The latest offering of direct drive wind turbines, where the use of rare-earth magnets allows the gearbox to be removed from the turbine, has greatly decreased weight and maintenance issues.

Along with the above applications, rare-earth magnets are widely used in major consumer and industrial electronic applications, such as smartphones, acoustic speakers, hard disk drives, due to their high performance to size ratio and high magnetic strength. The usage of rare-earth metals in permanent magnets is expected to grow by 12% to 14% in the next five to ten years.

Rare-earth metals are also widely used in catalyst systems. Their main contribution in a catalyst system is to absorb, store, and release oxygen and stabilize the environments in which they operate. The rare-earth metals, which are widely used in catalyst systems are lanthanum and cerium. They are mainly applied as catalysts in automotive catalytic converters for cars and other vehicles and fluid cracking catalysts (FCC’s) used in oil refineries. Apart from growth in worldwide unit sales, demand for auto-catalysts is further complemented by increasingly demanding legislation around the world governing vehicle emissions. It is expected that the demand for rare-earth metals in auto-catalysts has the potential to continue to grow by about 6% per annum.

Restraint: Fluctuating costs of rare-earth metals

The global recession of 2008-09 had several negative implications on a number of markets, and the rare-earth metals market was not an exception. The rare-earth metal prices increased suddenly in 2011 after China introduced a 40% cut on its export quotas, citing environmental reasons. The cost of dysprosium oxide, used in magnets, lasers, and nuclear reactors, rose to about USD 1,470 a kilogram from USD 700 to USD 740, buoyed by demand and concerns over future availability.

These fluctuations in prices coupled with rising energy costs are destabilizing the supply chains of rare-earth elements. This factor makes it difficult for manufacturers to deliver quality products at a profit

As the prices of raw materials fluctuate, it depends on the manufacturers to either absorb additional costs or increase the prices of the products. The demand for rare-earth metals is dependent on the demand for its applications. Furthermore, the demand for the applications is dependent on the end-user industries. Hence, the rare-earth metal has a double supply chain, which further increases the final price demanded by manufacturers. Thus, price fluctuations leave no room for error when planning a project’s budget and have quite a few manufacturers walking a thin line between success and operating at a loss.

When the price of raw materials increases suddenly, a few manufacturers search for new suppliers that allow them to maintain revenue targets. This often means sourcing materials from the lower-cost economies. Switching to a different source of raw materials carries a high risk of disrupting the supply chain.

Rare-earth elements are not traded in any exchange in the way other precious or nonferrous metals are. They are rather sold in the private market, which makes their prices tricky to track and monitor. The elements are not usually sold in their pure form, but distributed in mixtures of varying purity, for example, 99% neodymium metal. In any case, pricing can vary based on the quantity and quality required by the end- use applications.

Opportunity: New Recycling and reuse of rare-earth metals

Rare-earth metals were comparatively cheaper before new applications were discovered for their use. This created a discrepancy in the supply and demand chain of the rare-earth metals, which was due to an enormous increase in the prices of the metals. Earlier, the metals were not as critical as they have become over the past five years. Hence, a lot of them were wasted due to inconsistent demand and supply. Currently, the situation is different for the rare-earth metals. Many critical industries, including the green technology and defense use a lot of rare-earth metals. The substantial price increase of the metals in 2011 made these metals even more critical and valuable for other countries, including the US, which has led to a global drive for recycling.

Recycling is a method to decrease the criticality of the metals and provide a secondary source of supply for the key metals. The existing recycling rate for the rare-earth metals is less than 5% which presents a significant opportunity for important recycling efforts. Recycling will not only provide a secondary source of supply, but will also have a positive impact on the environment with decreased mining. It will also minimize the impact of waste and toxins entering water sources.

The US Department of Energy, in collaboration with Oak Ridge National Laboratory (ORNL) developed a recycling technology that uses a combination of hollow fiber membranes, organic solvents, and neutral extractants to recover rare-earth elements, such as neodymium, praseodymium, and dysprosium from magnets.

In laboratory testing, the membrane extraction system demonstrated the potential to recover more than 90 percent of these three elements in a highly pure form from scrap neodymium-based magnets. ORNL expects the figure to be closer to 97 percent. The resulting product is a 99.6 percent pure combination of rare-earth materials.

The Neodymium Oxide segment is projected to lead the global rare-earth metals market through 2026

Neodymium oxide is used to produce magnets which are found in most modern vehicles and aircraft as well as popular consumer electronics, such as headphones, microphones, and computer discs . It is used in high-strength permanent magnets that are also known as neodymium-iron-boron (NdFeB) magnets and are one of the strongest magnets in the world. Incresing use of Clean energy application has driven the market.

The Phosphors segment is projected to grow at the highest CAGR during the forecast period.

The Phosphors segment, by application, is projected to grow at the highest CAGR during the forecast period. Phosphors used in many applications that require color in the light exhibited, namely, cathode ray tube displays, fluorescent lamps, and other applications. The important elements in this sector are europium, terbium, and yttrium. Phosphors are used to convert the incident radiation into the light of designed colors. This is based on the properties of the elements that are included in the phosphors. The demand for rare-earth oxide phosphor products is expected to increase, due to the government policies in US, Canada, China, among other countries, and the European Union, where the incandescent lamps are being replaced with fluorescent and LED lamps.

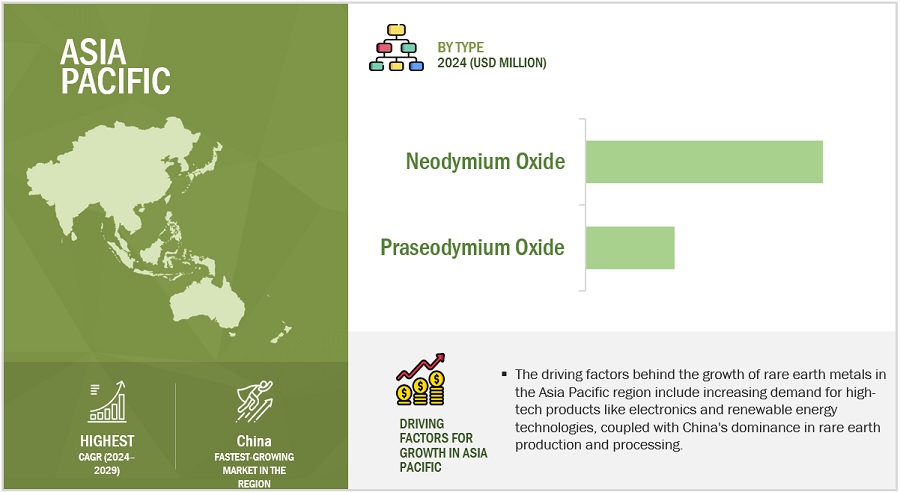

The Asia Pacific is projected to hold the largest share in the rare-earth metals market during the forecast period

APAC is the top region in terms of total rare-earth material consumption due to rapidly increasing demand in China, which accounts for maximum global rare-earth consumption. It was the largest consumer of rare-earth elements in 2019, with an estimated market revenue of over USD 5.2 billion. The region is also expected to witness the fastest-growth in terms of consumption due to growing industrialization and extraction activities in China.

Rare-Earth Metals Market Players

Key players operating in the rare-earth material market are Lynas Corporation (Australia), Alkane Resources ltd (Australia), Arafura Resources Ltd (Australia), China Minmetals Rare Earth Co Ltd (China), Avalon Advanced Materials, Inc (Canada), Iluka Resource Ltd (Australia), Canada Rare Earth Corporation (Canada). These players have adopted various growth strategies to expand their global presence and increase their market share.

Rare Earth Metals Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 5.3 billion |

|

Revenue Forecast in 2026 |

USD 9.6 billion |

|

CAGR |

12.3% |

|

Market size available for years |

2019-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, and the ROW. |

|

Companies covered |

Lynas Corporation (Australia), Alkane Resources ltd (Australia), Arafura Resources Ltd (Australia), China Minmetals Rare Earth Co Ltd (China), Avalon Advanced Materials, Inc (Canada), Iluka Resource Ltd (Australia), Canada Rare Earth Corporation (Canada). |

This research report categorizes the rare-earth metals market based on type, application and region.

Based on Type:

- Cerium Oxide

- Lanthanum Oxide

- Neodymium Oxide

- Yttrium Oxide

- Praseodymium Oxide

- Samarium Oxide

- Gadolinium Oxide

- Dysprosium Oxide

- Terbium Oxide

- Europium Oxide

- Other Oxides

Based on the Application

- Permanent Magnets

- Metal Alloys

- Glass Polishing

- Glass Additives

- Catalysts

- Phosphors

- Ceramics

- Others

Based on the Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (ROW)

Recent Developments

- In May 2019, Lynas Corporation and Blue Line announced a joint venture to develop rare earths separation capacity in the US.

- In April 2019, In April, the company invested USD 2.16 million in Calidus Resources Limited, a gold exploration company in Australia..

- In March 2019, Lynas Corporation signed an MoU with MARA to commercialize the neutralization underflow residue from the Lynas Malaysia plant

Frequently Asked Questions (FAQ):

What is the current size of global rare-earth metals market?

The rare-earth metals market is projected to grow from USD 5.3 billion in 2021 to USD 9.6 billion by 2026, at a CAGR of 12.33% during the forecast period

How is the rare-earth metals market aligned?

The rare-earth metals market is relatively consolidated, and has several global and regional players who have a very strong presence in the market. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key players in the global rare-earth metals market?

The rare-earth metals market is dominated by a few globally established players, such as Lynas Corporation (Australia), Alkane Resources ltd (Australia), Arafura Resources Ltd (Australia), China Minmetals Rare Earth Co Ltd (China), Avalon Advanced Materials, Inc (Canada), Iluka Resource Ltd (Australia), Canada Rare Earth Corporation (Canada).).

What are the factors driving the rare-earth metals market?

- Increasing demand from end-use industries

- Increasing demand for clean energy

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 RARE-EARTH METALS: MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES MADE IN THE REVAMPED VERSION

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH

FIGURE 2 APPROACH (BOTTOM-UP)

FIGURE 3 APPROACH (TOP-DOWN)

FIGURE 4 METHODOLOGY FOR MARKET ESTIMATION

2.3 DATA TRIANGULATION

FIGURE 5 REAR-EARTH METALS MARKET: DATA TRIANGULATION

FIGURE 6 KEY MARKET INSIGHTS

FIGURE 7 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 8 NEODYMIUM OXIDE TYPE TO ACCOUNT FOR LARGEST MARKET SIZE

FIGURE 9 PERMANENT MAGNETS LEADS THE APPLICATION SEGMENT

FIGURE 10 APAC TO GROW AT THE HIGHEST RATE IN THE RARE-EARTH METALS MARKET

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 APAC TO WITNESS A HIGHER GROWTH RATE DUE TO HIGH GROWING DEMAND FOR SEVERAL APPLICATIONS

FIGURE 11 INCREASING DEMAND FOR ELECTRIC VEHICLES TO DRIVE THE RARE-EARTH METALS MARKET

4.2 RARE-EARTH METALS MARKET: BY REGION AND APPLICATION

FIGURE 12 APAC AND PERMANENT MAGNETS LED THEIR RESPECTIVE SEGMENTS IN THE MARKET IN 2020

4.3 RARE-EARTH METALS MARKET, BY COUNTRY

FIGURE 13 THE RARE-EARTH METALS MARKET IN BRAZIL IS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES, IN THE RARE-EARTH METALS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand from end-use industries

FIGURE 15 GLOBAL AUTOMOBILE PRODUCTION DATA, 2016-2019

FIGURE 16 GLOBAL ELECTRIC VEHICLE PRODUCTION DATA, 2016-2019

5.2.1.2 Increasing demand for clean energy

FIGURE 17 GLOBAL ENERGY DEMAND

FIGURE 18 GLOBAL WIND POWER CUMULATIVE CAPACITY

FIGURE 19 GLOBAL WIND POWER CUMULATIVE CAPACITY PROJECTION 2020-2024

5.2.1.3 Initiative of associations & regulatory bodies

5.2.2 RESTRAINTS

5.2.2.1 Fluctuating costs of rare-earth metals

5.2.2.2 Dominance of China in the rare-earth metals market

5.2.2.3 Illegal mining of rare-earth metal ores

5.2.3 OPPORTUNITIES

5.2.3.1 Recycling and reuse of rare-earth metals

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 RARE-EARTH METALS MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 1 RARE-EARTH METALS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 RARE-EARTH METALS VALUE CHAIN

5.4.1 MINING & RARE-EARTH ORE PRODUCTION

5.4.2 SEPARATION OF RARE-EARTH ORE TO FORM RARE-EARTH OXIDES

5.4.3 REFINING OF THE RARE-EARTH OXIDES

5.4.4 APPLICATIONS

5.4.5 END-USE INDUSTRIES

5.5 TRENDS

5.5.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR RARE-EARTH METAL MANUFACTURERS

FIGURE 22 REVENUE SHIFT FOR RARE-EARTH METAL MANUFACTURERS

5.6 REGULATORY LANDSCAPE

5.7 TECHNOLOGY ANALYSIS

5.8 CASE STUDY ANALYSIS

5.8.1 CASE STUDY OF THE CHINA’S GROWING CONFLICT WITH THE WTO (WORLD TRADE ORGANIZATION): THE CASE OF EXPORT RESTRICTIONS ON RARE-EARTH RESOURCES

5.8.2 CHINA’S GROWING CONFLICT WITH THE WTO

5.9 MARKET MAP

FIGURE 23 MARKET MAP FOR RARE-EARTH METALS MARKET

5.10 RARE-EARTH METALS MARKET: PATENT ANALYSIS

5.10.1 INNOVATIONS & PATENT REGISTRATION

TABLE 2 IMPORTANT INNOVATION & PATENT REGISTRATION, 2016–2020

5.11 PRICING ANALYSIS

FIGURE 24 MONTHLY CERIUM OXIDE PRICES, 2020

FIGURE 25 MONTHLY LANTHANUM OXIDE PRICES, 2020

FIGURE 26 MONTHLY NEODYMIUM OXIDE PRICES, 2020

FIGURE 27 MONTHLY YTTRIUM OXIDE PRICES, 2020

FIGURE 28 MONTHLY PRASEODYMIUM OXIDE PRICES, 2020

FIGURE 29 MONTHLY SAMARIUM OXIDE PRICES, 2020

FIGURE 30 MONTHLY GADOLINIUM OXIDE PRICES, 2020

FIGURE 31 MONTHLY DYSPROSIUM OXIDE PRICES, 2020

FIGURE 32 MONTHLY TERBIUM OXIDE PRICES, 2020

FIGURE 33 MONTHLY EUROPIUM OXIDE PRICES, 2020

TABLE 3 MONTHLY AVERAGE RARE-EARTH OXIDE PRICES: JANUARY 2020-JUNE 2020 (USD/METRIC TON)

TABLE 4 MONTHLY AVERAGE RARE-EARTH OXIDE PRICES: JULY 2020-DECEMBER 2020 (USD/METRIC TON)

TABLE 5 AVERAGE PRICES FOR RARE-EARTH OXIDES (USD/ METRIC TON), 2020

5.12 TRADE DATA

TABLE 6 EXPORT TRADE DATA FOR RARE-EARTH METALS (2019)

TABLE 7 IMPORT TRADE DATA FOR RARE-EARTH METALS (2019)

6 COVID-19 IMPACT ON RARE-EARTH METALS MARKET (Page No. - 63)

6.1 COVID-19 IMPACT ON RARE-EARTH METAL END-USE INDUSTRIES

7 RARE-EARTH METALS MARKET, BY TYPE (Page No. - 65)

7.1 INTRODUCTION

FIGURE 34 NEODYMIUM OXIDE SEGMENT TO LEAD THE MARKET

TABLE 8 RARE-EARTH METALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 9 RARE-EARTH METALS MARKET SIZE, BY TYPE, 2019–2026 (METRIC TON)

7.2 DYSPROSIUM OXIDE

7.2.1 MOST PREFERRED TYPE FOR GLASS AND CAMERA LENSES

TABLE 10 LANTHANUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 11 LANTHANUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.3 YTTRIUM OXIDE

7.3.1 GENERALLY USED AS CATALYST IN AUTOMOTIVE EXHAUST SYSTEM

TABLE 12 CERIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 13 CERIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.4 OTHERS

7.4.1 CAN BE USED FOR CREATING HIGH-STRENGTH METALS FOUND IN AIRCRAFT ENGINES

TABLE 14 PRASEODYMIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 15 PRASEODYMIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.5 LANTHANUM OXIDE

7.5.1 USED FOR MAKING PERMANENT MAGNETS

TABLE 16 NEODYMIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 17 NEODYMIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.6 CERIUM OXIDE

7.6.1 USED FOR MAKING PERMANENT MAGNETS FOR DEFENSE & COMMERCIAL TECHNOLOGIES

TABLE 18 SAMARIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 19 SAMARIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.7 PRASEODYMIUM OXIDE

7.7.1 GENERALLY USED IN MAKING VISIBLE LIGHTS IN COMPACT FLUORESCENT BULBS

TABLE 20 EUROPIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 21 EUROPIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.8 NEODYMIUM OXIDE

7.8.1 USED AS A MAJOR CONTRIBUTOR TO MODERN HEALTHCARE SOLUTIONS

TABLE 22 GADOLINIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 23 GADOLINIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.9 SAMARIUM OXIDE

7.9.1 USED IN COMPACT FLUORESCENT LIGHTING AND COLOR DISPLAYS

TABLE 24 TERBIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 25 TERBIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.10 EUROPIUM OXIDE

7.10.1 USED IN LASERS AND COMMERCIAL LIGHTING

TABLE 26 DYSPROSIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 27 DYSPROSIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.11 GADOLINIUM OXIDE

7.11.1 GENERALLY USED TO PRODUCE SUPERCONDUCTORS

TABLE 28 YTTRIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 29 YTTRIUM OXIDE MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.12 TERBIUM OXIDE

TABLE 30 OTHER OXIDES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 31 OTHER OXIDES MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

8 RARE-EARTH METALS MARKET, BY APPLICATION (Page No. - 80)

8.1 INTRODUCTION

FIGURE 35 PERMANENT MAGNETS SEGMENT TO LEAD THE MARKET

TABLE 32 RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 33 RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

8.2 PERMANENT MAGNETS

8.2.1 GROWING AUTOMOTIVE INDUSTRY IS DRIVING THE SEGMENT

TABLE 34 REAR EARTH METALS MARKET SIZE IN PERMANENT MAGNETS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 REAR EARTH METALS MARKET SIZE IN PERMANENT MAGNETS, BY TYPE, 2019–2026 (METRIC TON)

8.3 CATALYSTS

8.3.1 CATALYST ARE EXTENSIVELY USED IN AUTOMOTIVE EXHAUST SYSTEM

TABLE 36 REAR EARTH METALS MARKET SIZE IN CATALYSTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 37 REAR EARTH METALS MARKET SIZE IN CATALYSTS, BY TYPE, 2019–2026 (METRIC TON)

8.4 GLASS POLISHING

8.4.1 DEMAND FOR GLASS POLISHING IS INCREASING IN VARIOUS END-USE INDUSTRIES

TABLE 38 REAR EARTH METALS MARKET SIZE IN GLASS POLISHING, BY TYPE, 2019–2026 (USD MILLION)

TABLE 39 REAR EARTH MARKET SIZE IN GLASS POLISHING, BY TYPE, 2019–2026 (METRIC TON)

8.5 PHOSPHORS

8.5.1 INCREASING NEED FOR FLUORESCENT AND LED LAMPS DRIVES THE DEMAND FOR PHOSPHORS

TABLE 40 REAR EARTH METALS MARKET SIZE IN PHOSPHORS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 41 REAR EARTH METALS MARKET SIZE IN PHOSPHORS, BY TYPE, 2019–2026 (METRIC TON)

8.6 CERAMICS

8.6.1 INCREASED USE OF CERAMICS IN INDUSTRIAL ELECTRONICS

TABLE 42 RARE-EARTH METALS MARKET SIZE IN CERAMICS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 RARE-EARTH METALS MARKET SIZE IN CERAMICS, BY TYPE, 2019–2026 (METRIC TON)

8.7 METAL ALLOYS

8.7.1 INCREASED USE OF RARE-EARTH METALS FOR IMPROVING THE PHYSICAL PROPERTIES OF THE ALLOYS

TABLE 44 RARE-EARTH METALS MARKET SIZE IN METAL ALLOYS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 RARE-EARTH METALS MARKET SIZE IN METAL ALLOYS, BY TYPE, 2019–2026 (METRIC TON)

8.8 GLASS ADDITIVES

8.8.1 RARE-EARTH METALS IMPROVE REFRACTIVE INDEX OF GLASS, WHICH DRIVES THE MARKET

TABLE 46 RARE-EARTH METALS MARKET SIZE IN GLASS ADDITIVES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 47 RARE-EARTH METALS MARKET SIZE IN GLASS ADDITIVES, BY TYPE, 2019–2026 (METRIC TON)

8.9 OTHERS

TABLE 48 RARE-EARTH METALS MARKET SIZE IN OTHER APPLICATIONS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 49 RARE-EARTH MARKET SIZE IN OTHER APPLICATIONS, BY TYPE, 2019–2026 (METRIC TON)

9 RARE-EARTH METALS MARKET, BY REGION (Page No. - 91)

9.1 INTRODUCTION

FIGURE 36 REGIONAL SNAPSHOT: CHINA TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FROM 2021 TO 2026

TABLE 50 RARE-EARTH METALS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 51 RARE EARTH METALS MARKET SIZE, BY REGION, 2018–2025 (METRIC TON)

TABLE 52 RARE-EARTH METALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 RARE EARTH METALS MARKET SIZE, BY TYPE, 2019–2026 (METRIC TON)

TABLE 54 RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.2 APAC

FIGURE 37 APAC: RARE-EARTH METALS MARKET SNAPSHOT

TABLE 55 APAC: RARE EARTH METALS MARKET SIZE, BY COUNTRY, 2019–2026 (METRIC TON)

TABLE 56 APAC: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 57 APAC: MARKET SIZE, BY TYPE, 2019–2026 (METRIC TON)

TABLE 58 APAC: MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.2.1 CHINA

9.2.1.1 Largest producer and consumer of rare-earth metals

TABLE 59 CHINA: RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.2.2 JAPAN

9.2.2.1 New sources of rare-earth metals will make the country self-sufficient

TABLE 60 JAPAN: RARE EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.2.3 REST OF APAC

TABLE 61 REST OF APAC: RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.3 NORTH AMERICA

TABLE 62 NORTH AMERICA: RARE-EARTH METALS MARKET SIZE, BY COUNTRY,

TABLE 63 NORTH AMERICA: RARE-EARTH METALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: RARE EARTH METALS MARKET SIZE, BY TYPE, 2019–2026 (METRIC TON)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.3.1 US

9.3.1.1 Rising demand for electric vehicles drives market

TABLE 66 US: RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.3.2 CANADA

9.3.2.1 Need for clean energy applications drives the market

TABLE 67 CANADA: RARE EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.3.3 MEXICO

9.3.3.1 Green technology, consumer electronics, and high-tech applications drive the demand for rare-earth metals

TABLE 68 MEXICO: RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.4 EUROPE

TABLE 69 EUROPE: RARE-EARTH METALS MARKET SIZE, BY COUNTRY, 2019–2026 (METRIC TON)

TABLE 70 EUROPE: RARE EARTH METALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (METRIC TON)

TABLE 72 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.4.1 GERMANY

9.4.1.1 Rising demand for electric vehicles drives the market

TABLE 73 GERMANY : RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.4.2 UK

9.4.2.1 Increased demand for rare-earth metals in wind turbines and electric vehicles

TABLE 74 UK: RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.4.3 FRANCE

9.4.3.1 Increase in demand for rare-earth metals by high-technology and low-carbon industries

TABLE 75 FRANCE: RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.4.4 REST OF EUROPE

TABLE 76 REST OF EUROPE: RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.5 REST OF THE WORLD

TABLE 77 REST OF THE WORLD : RARE-EARTH METALS MARKET SIZE, BY COUNTRY, 2019–2026 (METRIC TON)

TABLE 78 REST OF THE WORLD : RARE EARTH METALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 REST OF THE WORLD : MARKET SIZE, BY TYPE, 2019–2026 (METRIC TON)

TABLE 80 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.5.1 BRAZIL

9.5.1.1 Rising demand for rare-earth metals in wind turbines and electric vehicles

TABLE 81 BRAZIL: RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

9.5.2 OTHER COUNTRIES IN REST OF THE WORLD

TABLE 82 OTHER COUNTRIES IN REST OF THE WORLD: RARE-EARTH METALS MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

10 COMPETITIVE LANDSCAPE (Page No. - 114)

10.1 KEY PLAYER STRATEGIES

TABLE 83 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, 2019–2020

10.2 MARKET EVALUATION FRAMEWORK

TABLE 84 MARKET EVALUATION FRAMEWORK

10.3 COMPANY EVALUATION QUADRANT

10.3.1 STAR

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE

10.3.4 PARTICIPANT

FIGURE 38 COMPETITIVE LEADERSHIP MAPPING: RARE-EARTH METALS MARKET, 2019

TABLE 85 COMPANY PRODUCT FOOTPRINT

TABLE 86 COMPANY APPLICATION FOOTPRINT

TABLE 87 COMPANY INDUSTRY FOOTPRINT

TABLE 88 COMPANY REGION FOOTPRINT

10.4 COMPETITIVE SCENARIO

TABLE 89 JANUARY 2019–JANUARY 2021

11 COMPANY PROFILES (Page No. - 123)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

11.1 KEY PLAYERS

11.1.1 LYNAS CORPORATION

TABLE 90 LYNAS CORPORATION: BUSINESS OVERVIEW

FIGURE 39 LYNAS CORPORATION: COMPANY SNAPSHOT

11.1.2 ALKANE RESOURCES LTD

TABLE 91 ALKANE RESOURCES LTD: BUSINESS OVERVIEW

FIGURE 40 ALKANE RESOURCES LTD: COMPANY SNAPSHOT

11.1.3 ARAFURA RESOURCES LTD

TABLE 92 ARAFURA RESOURCES LTD: BUSINESS OVERVIEW

11.1.4 CHINA MINMETALS RARE EARTH CO LTD

TABLE 93 CHINA MINMETALS RARE EARTH CO LTD: BUSINESS OVERVIEW

FIGURE 41 CHINA MINMETALS RARE EARTH CO LTD: COMPANY SNAPSHOT

11.1.5 AVALON ADVANCED MATERIAL INC

TABLE 94 AVALON ADVANCED MATERIAL INC: BUSINESS OVERVIEW

11.1.6 BAOTOU HEFA RARE EARTH CO LTD

TABLE 95 BAOTOU HEFA RARE EARTH CO LTD: BUSINESS OVERVIEW

11.1.7 CANADA RARE EARTH CORPORATION

TABLE 96 CANADA RARE EARTH CORPORATION: BUSINESS OVERVIEW

FIGURE 42 CANADA RARE EARTH CORPORATION: COMPANY SNAPSHOT

11.1.8 ILUKA RESOURCE LTD (ILUKA)

TABLE 97 ILUKA RESOURCE LTD (ILUKA): BUSINESS OVERVIEW

FIGURE 43 ILUKA RESOURCE LTD: COMPANY SNAPSHOT

11.1.9 NORTHERN MINERALS LIMITED

TABLE 98 NORTHERN MINERALS LIMITED: BUSINESS OVERVIEW

11.1.10 GREENLAND MINERALS LTD

TABLE 99 GREENLAND MINERALS LTD: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 NEO MATERIALS

11.2.2 SHIN-ETSU CHEMICAL CO., LTD

11.2.3 EUTECTIX, LLC

11.2.4 CHINA NONFERROUS METAL INDUSTRY’S FOREIGN ENGINEERING AND CONSTRUCTION CO., LTD

11.2.5 AMERICAN RARE EARTHS LIMITED

11.2.6 CHINA NORTHERN RARE EARTH (GROUP) HIGH-TECH CO., LTD.

11.2.7 BAOTOU JINMENG RARE EARTH CO., LTD

11.2.8 UCORE RARE METALS INC

11.2.9 MITSUBISHI CORPORATION RTM JAPAN LTD.

11.2.10 MEDALLION RESOURCES LTD

12 APPENDIX (Page No. - 150)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities for estimating the current global size of the rare-earth metals market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of rare-earth metals through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the rare-earth metals market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Rare-Earth Metals Market Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the rare-earth metals market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Rare-Earth Metals Market Primary Research

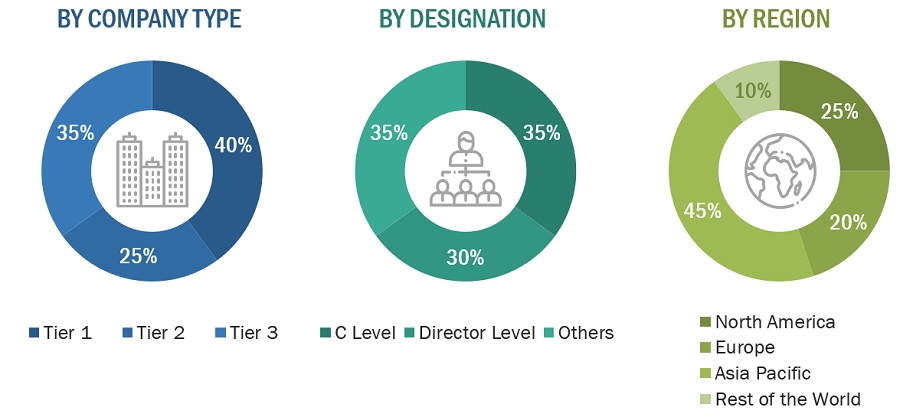

Various primary sources from both the supply and demand sides of the rare earth metals market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the rare-earth metals industry. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Rare-Earth Metals Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the rare-earth metals market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Rare-Earth Metals Market Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the rare-earth metals market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, describe, and forecast the rare-earth metals market in terms of value

- To elaborate drivers, restraints, opportunities, and challenges in the market

- To analyze and forecast the market size on the basis of type, and application.

- To forecast the market size, along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), the ROW along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their core competencies2

- To analyze competitive developments in the market, such as agreements, joint venture & contracts.

Rare-Earth Metals Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the rare-earth metals report:

Rare-Earth Metals Market Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Rare-Earth Metals Market Regional Analysis

- Further analysis of the rare-earth metals market for additional countries

Rare-Earth Metals Market Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Rare-Earth Metals Market