AbbVie Acquisition Strengthens Its Neuroscience Portfolio

The structure of AbbVie Inc.s (NYSE:ABBV) buyout of a clinical-stage biotechnology company this week may be indicative of the type of deals were going to see more of. The Chicago-area company back-loaded the acquisition of privately held Syndesi Therapeutics, paying $130 million initially, with the opportunity for shareholders of the Belgium-based company to collect another $870 million if predetermined milestones are achieved.

Making only the up-front portion of merger and acquisition deals is having a bigger impact on some therapy areas than others, according to the pharma consulting group Evaluate. Cancer is still the leading disease area by a wide margin, with the number of oncology acquisitions hitting a five-year high in 2021. Second is neuroscience and third is companies working in the field of rare diseases.

The Syndesis deal strengthens AbbVies portfolio of neuropsychiatric and neurodegenerative drugs. The company said Syndesis lead candidate, SD-118, could potentially be used to treat cognitive impairment and other symptoms associated with a range of disorders such as Alzheimer's disease and major depressive disorder.

For AbbVie, the acquisition of Syndesi is expected to complement its ongoing neurodegenerative disease collaboration with Mission Therapeutics. Last year, the two companies put forward two enzyme targets as potential therapies for Alzheimers and Parkinsons.

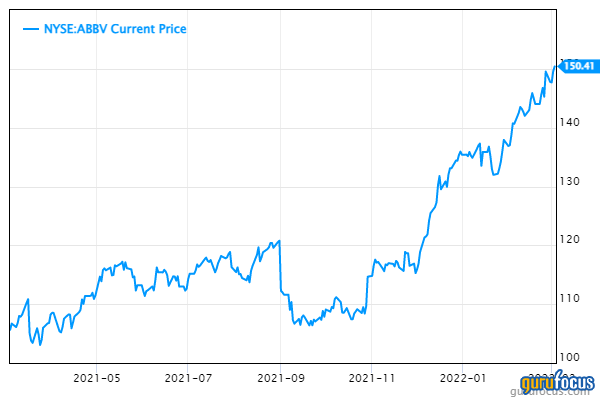

Caption: AbbVie shares are up more than 40% in the past year.

Five-year-old Syndesi is backed by Novo Holdings. In 2018, the company licensed SDI-118, which had been discovered by UCB Biopharma SRL, one of the organizations that helped launch Syndesi.

A small molecule, SDI-118 is currently in phase Ib studies. In the study, the treatment targets nerve terminals to enhance synaptic efficiency. In its announcement, AbbVie said that synaptic dysfunction is believed to be an underlying issue in cognitive impairment that is associated with multiple disorders.

Meanwhile, the growing appetite for neuroscience targets is driving more risk-sharing in deal structures, as AbbVies acquisition of Syndesi demonstrates. Last year, 39% of deals with disclosed terms involved an up-front fee, the highest in at least five years.

AbbVie has richly rewarded shareholders. In the past year, the stock is up more than 40% and currently trades just short of its 52-week high of $151.25. It is rated a buy, according to Yahoo Finance. The companys dividend yields 3.77%.

This article first appeared on GuruFocus.